is there real estate transfer tax in florida

The state of Florida commonly refers to transfer tax as documentary stamp tax. The transfer tax in Florida is levied at 70 cents for each 100 of consideration for most recorded documents including deeds of conveyance.

Free Florida General Warranty Deed Form Pdf Word Eforms

PDF 125 KB.

. This tax is normally paid at closing to the Clerk of. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. The Florida documentary stamp tax is applied at a rate of 070 per 100 paid for the property in every.

Typically the real estate agent obtains a check for the amount from the seller. Does Florida have real estate transfer tax. People who transfer real estate by deed must pay a transfer fee.

Its customary for the seller of the property to pay for this tax in Florida. The blogs to follow will address specific issues to guide buyers to understand the process better and to help them avoid many of the pitfalls. Since there is no other consideration for the transfer.

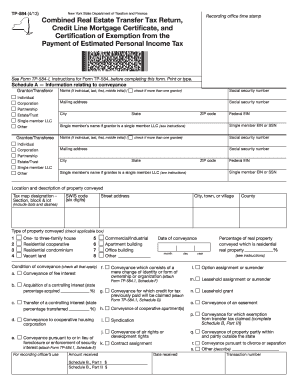

The tax is called documentary stamp tax and is an excise tax on the deed. Further for all other types of transfers in Miami-Dade County there. This fee is charged by the recording offices in most counties.

If passed this new transfer tax would be 20 for amounts over 2. Miami-Dades tax rate is 60 cents. Sales and Use Tax.

The Florida documentary stamp tax is a real estate transfer tax. In Florida transfer tax is called a documentary. The District of Columbia reduces its deed recordation tax for first-time homebuyers to 0725 for values up to 400000.

Documents that transfer an interest in Florida real property such as deeds. According to the Florida Department of Revenue the tax rate is 035 per 100 of indebtedness on the mortgage. Property Tax Exemptions and Additional Benefits.

The Massachusetts real estate transfer excise tax is currently 258 per 500 value transferred which is a 0456 tax rate. Arizona has only a. Call us at 561 408-0729 or visit.

Its customary for the seller of the property to pay for this tax in Florida. There is currently no Boston. The average property tax rate in Florida is 083.

In Florida this fee is called the Florida documentary stamp. There are also special tax districts such as schools and water management districts that. Miami-Dades tax rate is 60 cents.

Each county sets its own tax rate. Are there real estate transfer taxes in California. Massachusetts MA Transfer Tax.

In Miami-Dade County however the stamp tax rate is 60 per 100 or a rate of 06 for transfers of single-family residences. For the purposes of determining. Mortgages are also subject to the documentary stamp tax.

There is no specific exemption for documents that transfer Florida real property for estate planning. Real Estate Transfer Tax Florida imposes a transfer tax on the transfer of real property in Florida.

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Real Estate Transfer Tax Paid For Bj S Wholesale Club Property Sale Albany Business Review

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/URGPECSXRNDTNFO3IH6EIDFN64.jpg)

Philly Misses Full Bounty Of Shops At Schmidts Sale As Transfer Tax Shortfalls Persist

Transfer Tax And Documentary Stamp Tax Florida

A Non Residents Guide To Buying Property In Florida

Mansion Tax Adds To Array Of Transfer Taxes When Buying Selling Real Property Marks Paneth

After Car Owner Dies How To Transfer Title

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Real Estate Transfer Tax What Are They Where Does The Money Go

Real Estate Property Tax Constitutional Tax Collector

Fillable Online Realpropertyabstract Printable Combined Real Estate Transfer Tax Return Tp584 Form Realpropertyabstract Fax Email Print Pdffiller

Florida Real Estate Taxes And Their Implications

Transfer Fee Evidence Local Option For Housing Affordability

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Florida Real Estate How Much Will It Cost Nmb Florida Realty

Calculating The State Transfer Taxes Oneblue Real Estate School Florida Real Estate Classes

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities